Adspend Bounces Back For The 2020 U.S. Holiday Shopping Season

With 39 percent of consumers starting their holiday shopping in October, advertisers are revisiting their adspend as the ecommerce shopping season is about to be in full swing. For consumers, the calm before the storm means crafting their shopping lists, comparing prices, and patiently waiting for the influx of promo codes to commence. For advertisers and retailers, this time consists of building a steady stream of enticing promotions, finalizing their digital campaigns, turning up the dials on adspend, and of course anticipating the competition’s every move.

Historically, holiday shopping has been marked by extensive lines, impulse buying, and pushing your way through stores to snag the best holiday deals. Fast forward to 2020, and this holiday shopping season is set to look quite different. With social distancing still in play, heightened health precautions, and an already increased familiarity with online shopping since COVID-19, consumers are looking for ease, safety, and of course deals.

Industry experts anticipate ecommerce shopping to flourish amid the coronavirus, especially for mega ecommerce companies. However, there is uncertainty over whether the boost will occur during the 2020 holiday season, or if the impact will start in 2021. Regardless of timing, advertisers need to be prepared to match the demand, which means more adspend and better deals.

Q4 holiday shopping events

To throw an extra curveball into the upcoming shopping season, Amazon Prime Day is moving to October 13, creating crossover with the mega-holiday events, which includes Black Friday and Cyber Monday. Brands often depend on Prime Day in Q3 to hit their annual sales target, whether they sell on Amazon or simply aspire to capture active shoppers. A push back on Prime Day will likely cannibalize Cyber Weekend sales for other retailers. According to a Coresight Research U.S. consumer survey, one-third of consumers are planning to make purchases on Prime Day with one-quarter purchasing on Cyber Monday and only 16 percent on Black Friday. Q4 is more important than ever this year, and allocating the right amount of adspend to the upcoming ecommerce holiday season is pivotal to success.

Adspend forecasts for advertisers

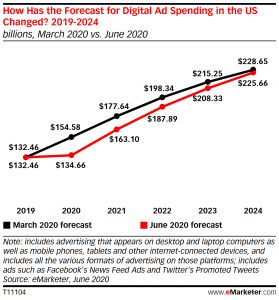

The impact of COVID-19 on advertisers’ holiday adspend has certainly been challenging to forecast. While advertisers and retailers will face plenty of disruptions and changes this holiday season, the good news is that digital adspend is predicted to increase. Annual U.S. adspend is projected to increase by 1.7 percent from 2019. Although forecasts for the year were once sitting high at 17 percent growth, any measure of increase is promising, considering many expected a decline in earlier months. In addition, U.S. digital adspend should resume its robust growth in 2021.

Source: eMarketer adspend update

Advertisers and retailers need to start planning holiday campaigns now if they haven’t already. 60 percent of last year’s Cyber Weekend sales were generated from consumers who had interacted with a brand’s email before Q3. As more businesses shift their efforts to ecommerce, the crowded marketplace for holiday advertising expands. Adspend is critical to compete for this upcoming seasons’ deal hunters, new ecommerce shoppers, and existing customers. In-person shopping skepticism and hard-to-predict Q4 sales will require advertisers and retailers to make more preparations for this unique holiday season.

Here are some essential insights from CAKE to help guide retailers and advertisers this holiday season.